iowa capital gains tax real estate

You have lived in the home as your principal residence for. Your tax rate is 20 on long-term capital gains if youre a single filer earning more than 445851 married filing jointly earning more than.

Capital Gains Tax Calculator Real Estate 1031 Exchange Capital Gains Tax Capital Gain What Is Capital

699 Walnut Street 4th Floor.

. Ad Looking for iowa capital gains tax rate. Real estate becomes exempt from capital gains tax if the home is considered your primary residence. However the state has an inheritance.

For tax years beginning on or after January 1 1998 net capital gains from the sale of the assets of a business described in subrules 40382 to 40388 are excluded in the computation of net income for qualified individual taxpayers. If you owned the property over a year youll pay long-term capital gains taxes at a rate of 0 15 or 20 depending on your income. For sales made on or after January 1 1990 Iowa taxpayers could claim a 45 deduction on qualifying capital gains as specified in a.

Iowa assesses transfer taxes at 080 per 500 with the first 500 exempt. Des Moines IA 50309. See General Instructions for Iowa Inheritance Tax Return IA 706.

Iowa has a unique state tax break for a limited set of capital gains. Iowa has a relatively high capital gains tax rate of 853 but the amount an individual actually needs to pay will generally be lower as the state allows a deduction for federal income tax. Toll Free 8773731031 Fax 8777797427.

Iowa tax law generally follows the federal guidelines on the exclusion of gain on the sale of a principal residence. Apply the Iowa capital gain deduction to proceeds from the sale of that property in the current or succeeding tax years see Division III below for new relevant law. Inheritance and Estate Tax and Inheritance and Estate Tax Exemption Iowas estate tax was repealed in 2008.

A Like-Kind Exchange with a conservation agency might help you protect land while deferring capital gains taxes. Single homeowners pay no capital gains taxes on the first 250000 in profits from the sale of their home. When a landowner dies the basis is automatically reset to the current fair market value at the time of death.

The Iowa capital gain deduction is subject to review by the Iowa Department of Revenue and must be reported on an Iowa Capital Gain Deduction IA 100 form. Rule 701-4038 - Capital gain deduction or exclusion for certain types of net capital gains. We talked about those income ranges earlier.

At that price the transfer taxes would be 24676. Iowa does not tax capital gains resulting from the sale of property used in trade or business for at least 10 years. 15000 x 22 3300 If you owned the home for one year or longer then youd be liable for the long-term capital gains tax rate.

For more information on the limitations of the inheritance tax clearance see Iowa Administrative Code rule70186122. A copy of your federal Schedule D and federal form 8949 if applicable must be included with this return if required for federal purposes. The real estate has to have been held for ten years and.

Before you complete the applicable Iowa Capital Gain Deduction IA 100 form review the Iowa Capital Gain. Includes short and long-term Federal and State Capital Gains Tax Rates for 2021 or 2022. Iowa Department of Revenue No.

Moreover the deduction could not exceed 17500 for the tax year. If you have large gains or high ordinary income you could see your capital gain rate jump 25 to a whopping 20 capital gain tax rate so plan ahead. Capital gains are taxed as ordinary income in Iowa.

The capital gains deduction has a fairly brief history on the Iowa 1040 Individual Income Tax Form. The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property. Cedar Rapids Des Moines Iowa City Davenport Ames Sioux City and Mason City.

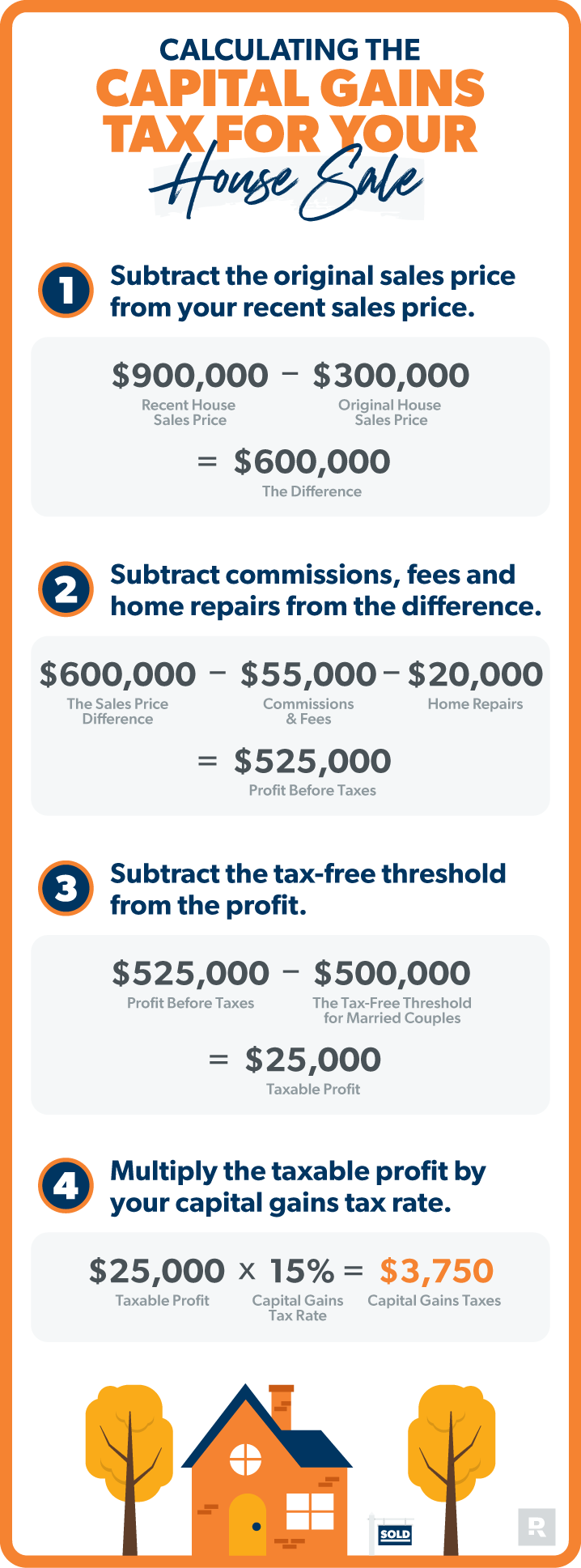

Your income and filing status make your capital gains tax rate on real estate 15. According to the. The IRS typically allows you to exclude up to.

In a nod to the states agricultural industry Iowa also has cutouts to its capital gains tax where family-owned business that have operated for a significant amount of time are eligible for certain. Content updated daily for iowa capital gains tax rate. As an example the median home value in Iowa is 154727 although that can vary widely depending on the specific city or town youre looking at.

CPEC1031 of Iowa provides qualified intermediary services throughout the state of Iowa including. Married homeowners filing jointly pay no taxes on their first 500000 in profits. Enter 100 of any capital gain or loss as reported on federal form 1040 line 7.

The Combined Rate accounts for Federal State and Local tax rates on capital gains income the 38 percent Surtax on capital gains and the marginal effect of Pease Limitations which results in a tax rate increase of 118 percent. So if you owned the property for less than a year youll pay short-term capital gains taxes at your normal income tax rate. 250000 of capital gains on real estate if youre single.

Iowaunlike some states. If you have income over 441850 at any given year you might want to delay the sale of an asset until your income drops below that amount. Recent Tax Reduction and Action However 2018 legislation slightly reduced the states personal income and individual capital gains tax rate from 898 percent to 853 percent in 2019.

How are capital gains taxed in Iowa. Take the beginning farmer tax credit in the current or succeeding tax years This provision applies to tax years beginning on or after January 1 2023. 500000 of capital gains on real estate if youre married and filing jointly.

On June 19 2020 the Iowa Supreme Court ruled that the Iowa Department of Revenue rationally interpreted Iowa Code 422721a to prevent a typical cash rental landlord from taking the Iowa capital gain deduction. At 22 your capital gains tax on this real estate sale would be 3300. You dont have to live in the property for the last two years either.

The tax clearance releases the property from the inheritance tax lien and permits the estate to be closed. Iowa allows taxpayers to deduct federal income taxes from their state taxable income. If line 6 of the IA 1040 includes a capital gain transaction you may have a qualifying Iowa capital gain deduction.

Certain sales of businesses or business real estate are excluded from Iowa taxation but only if they meet two stiff tests. Any two of the last five years qualifies you for the homeowner exclusion. Calculate the capital gains tax on a sale of real estate property equipment stock mutual fund or bonds.

Capital GAINS Tax. A Special Real Estate Exemption for Capital Gains Since 1997 up to 250000 in capital gains 500000 for a married couple on the sale of a home is exempt from taxation if you meet the following criteria.

How Much Is The Capital Gains Tax On Real Estate Ramseysolutions Com

The Beginner S Guide To Capital Gains Tax Infographic Transform Property Consulting Capital Gains Tax Capital Gain Investment Property

How Much Is Capital Gains Tax On Real Estate Plus How To Avoid It

What Is Capital Gains Tax And When Are You Exempt Thestreet

How High Are Capital Gains Taxes In Your State Tax Foundation

Cornering The Market Rental Income Advisors Rental Income Capital Gains Tax Rental

The Capital Gains Tax Rate Talked About A Lot But No Change Yet Welch Llp

How To Pay 0 Capital Gains Taxes With A Six Figure Income

Do You Have To Pay Capital Gains Tax On Property Sold Out Of State

The States With The Highest Capital Gains Tax Rates The Motley Fool

Capital Gains Tax Deferral Capital Gains Tax Exemptions

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

Capital Gains Tax Brackets For Home Sellers What S Your Rate Capital Gains Tax Capital Gain Tax Brackets

How To Calculate Capital Gains Tax H R Block

Capital Gains Tax Calculator 2022 Casaplorer

Capital Gains Tax Explained Propertyinvestment Flip Investing Knowthenumbers Capital Gains Tax Money Isn T Everything Capital Gain

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

If I Sell My House Do I Pay Capital Gains Taxes Edina Realty